The world of cryptocurrency can often feel complex, with terms like “tokenomics” sometimes adding to the confusion. Yet, understanding how a digital asset is structured—from its creation to its distribution—is crucial for anyone looking to engage with it. This article will demystify the tokenomics of Shell Token, a groundbreaking cryptocurrency initiative that bridges traditional energy markets with blockchain innovation. We’ll explore how Shell tokens are minted, allocated, and distributed among various stakeholders, offering a comprehensive look at its economic model and its implications for long-term sustainability and value.

The Foundation of Shell Tokenomics: A Capped Supply

At the heart of Shell Token’s economic model is a commitment to scarcity and sustainable growth, achieved through a meticulously designed tokenomics structure. Unlike some cryptocurrencies with inflationary supplies, Shell Token (SHELL) has a fixed maximum supply, ensuring a predictable economic environment for all participants.

Total Supply and Emission Schedule

The total supply of Shell Tokens is capped at 1 billion (1,000,000,000) tokens. This fixed supply is a critical element, as it helps to maintain scarcity and, theoretically, contributes to the token’s long-term value. While the total supply is fixed, the initial circulating supply will be considerably lower. Tokens are released into circulation according to a predetermined schedule, a strategy designed to prevent market flooding and encourage long-term holding among participants. This phased release aims to stabilize the market and align the interests of early adopters with the project’s sustained growth.

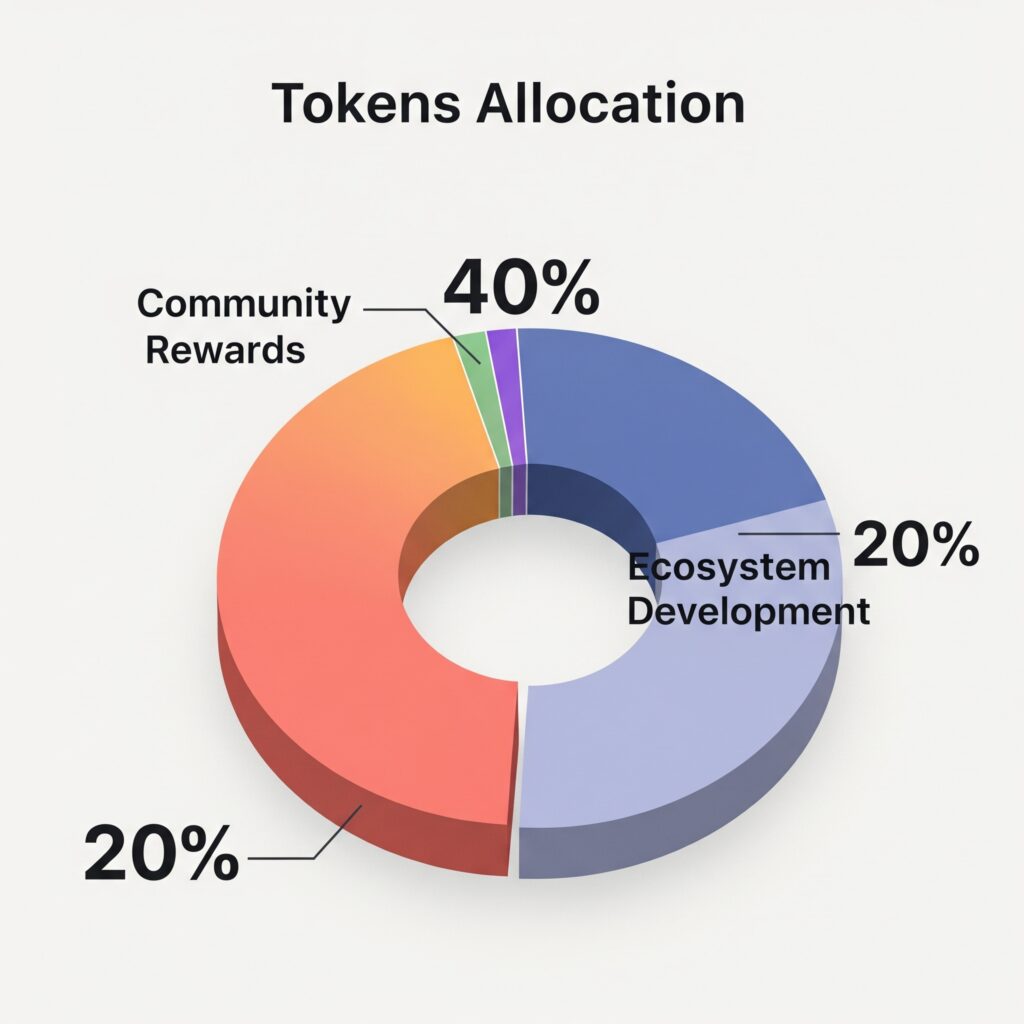

Token Allocation Details: A Stakeholder-Centric Approach

Shell Token’s distribution strategy is designed to foster a vibrant, community-driven ecosystem by allocating tokens across various essential functions and stakeholders. This approach ensures that the token serves multiple purposes, from rewarding loyal customers to funding technical development and ensuring market liquidity.

Community Rewards (40%)

A significant portion of the total token supply, 40%, is allocated specifically for Community Rewards. These tokens are dedicated to user incentives, forming the backbone of the loyalty program, environmental challenges, and community governance participation. These tokens are not released all at once; instead, they are distributed gradually over a period of five years, with the release tied to platform activity. This phased release mechanism ensures a continuous incentive for user engagement and contribution, directly rewarding participation in the energy transition and sustainability efforts.

- Practical Tip: For users, understanding this allocation means that active engagement with Shell Token’s loyalty program and sustainability challenges can lead to tangible rewards in SHELL tokens. Look out for opportunities to earn by purchasing fuel, shopping in-store, or participating in eco-friendly behaviors.

Ecosystem Development (20%)

To ensure the continuous evolution and expansion of the Shell Token platform, 20% of the tokens are allocated to Ecosystem Development. This allocation is crucial for funding technical advancements, integrating with Shell’s existing infrastructure, and building new features for the platform. To ensure long-term commitment from the development team, these tokens are subject to a 3-year vesting schedule, with a 6-month cliff. A “cliff” means that no tokens are released for the first six months, after which they begin to vest over the remaining period. This mechanism encourages the development team to remain invested in the project’s success over an extended period.

Liquidity Provision (15%)

15% of the Shell Token supply is dedicated to Liquidity Provision. This allocation is vital for establishing robust trading pairs on both decentralized (DEXs) and centralized (CEXs) exchanges, thereby ensuring sufficient market liquidity. Adequate liquidity is paramount for enabling smooth and efficient trading of SHELL tokens, reducing price volatility and improving the overall user experience for investors and traders. Of this portion, 5% is available at launch, with the remaining 10% vested over 24 months. This staggered release helps to maintain market stability and prevents large dumps of tokens at the initial stages.

- Hypothetical Scenario: Imagine a scenario where there’s very little liquidity for Shell Tokens on an exchange. If you wanted to buy a significant amount, your purchase could drastically push up the price due to low supply. Conversely, if you wanted to sell, you might struggle to find buyers at a fair price. The 15% allocation for liquidity provision aims to mitigate such issues, ensuring a healthier trading environment.

Team and Advisors (10%)

The Team and Advisors receive 10% of the total token supply. This allocation is designed to incentivize the core development team and strategic advisors, aligning their long-term interests with the success of the Shell Token project. Similar to the Ecosystem Development allocation, these tokens are subject to a 3-year vesting schedule, but with a longer 12-month cliff. This extended cliff period reinforces the commitment of the team and advisors to the project’s sustained growth and ensures they remain dedicated to its vision for years to come.

Marketing and Partnerships (10%)

To drive adoption and expand the Shell Token ecosystem, 10% of the tokens are reserved for Marketing and Partnerships. This includes initiatives to promote the token, attract new users, and forge strategic alliances with other entities in the blockchain ecosystem, environmental verification organizations, and retail technology providers. Effective marketing and strong partnerships are crucial for increasing visibility, fostering collaboration, and ultimately, expanding the reach and utility of Shell Token.

Reserve Fund (5%)

Finally, 5% of the token supply is allocated to a Reserve Fund. This fund acts as a contingency, providing financial resources to address unforeseen challenges, support future strategic initiatives, or navigate market fluctuations. The existence of a reserve fund demonstrates a proactive approach to risk management and long-term sustainability, ensuring the project has the flexibility to adapt to evolving circumstances.

Economic Sustainability: A Virtuous Cycle of Value

Beyond initial distribution, Shell Token’s tokenomics are engineered for long-term economic sustainability, creating a virtuous cycle where increased usage leads to both higher utility for users and appreciation potential for token holders. This is achieved through various utility and value mechanisms that encourage participation and create deflationary pressure.

Discounts and Rewards

A core utility of Shell Tokens is the ability to receive tiered discounts on Shell products and services. The more SHELL tokens a user holds, the greater their benefits. For instance, holding 10,000 SHELL might grant a 5% discount on fuel, while 100,000 SHELL could offer 10% off plus premium status benefits. This directly links token holding to real-world value, incentivizing long-term engagement.

- In your opinion, how impactful will tiered discounts be in driving mass adoption of Shell Token, especially for everyday consumers?

Deflationary Mechanisms

Shell Token incorporates several deflationary mechanisms designed to gradually reduce the circulating supply of tokens over time, creating scarcity and potentially increasing value. A portion of transaction fees (0.5%) is automatically burned. Additionally, tokens spent on premium services and exclusive NFTs are partially burned, creating consistent deflationary pressure as platform usage increases. This “burn” mechanism helps to counteract the natural increase in circulating supply from rewards, fostering a balanced economic environment.

Staking Mechanisms

Users have the opportunity to stake their tokens in various pools tied to different aspects of the ecosystem. Staking in the loyalty pool enhances reward rates, environmental pools contribute to sustainability projects, and governance pools increase voting power on platform decisions. Staking not only provides users with opportunities to earn returns but also strengthens the security and decentralization of the network by encouraging token holding and active participation. Staking rewards are partially funded by ecosystem revenue, creating sustainable yield opportunities.

Governance Rights

Shell Token holders gain voting rights proportional to their holdings, allowing them to participate in crucial decisions regarding new features, sustainability initiatives, and tokenomic adjustments. This ensures that the platform evolves according to community needs and fosters a truly decentralized and community-driven ecosystem. This democratic decision-making process empowers users to shape the future direction of Shell Token and its impact on the energy sector.

- Real-World Example: Imagine a proposal to fund a new renewable energy project through the Shell Token ecosystem. Token holders, through their governance rights, would be able to vote on whether to allocate resources to this project, directly influencing the token’s real-world impact.

Key Takeaways

- Fixed Supply: Shell Token (SHELL) has a capped total supply of 1 billion tokens, ensuring scarcity.

- Phased Release: Tokens are released gradually to prevent market flooding and encourage long-term holding.

- Community-Centric Allocation: 40% of tokens are dedicated to community rewards, fostering active participation.

- Sustainable Development: 20% is allocated for ecosystem development, with a vesting schedule for long-term commitment.

- Market Liquidity: 15% is reserved for liquidity provision to ensure smooth trading on exchanges.

- Team Alignment: 10% for the team and advisors, subject to vesting, aligns their interests with the project’s success.

- Growth and Partnerships: 10% is dedicated to marketing and strategic partnerships for ecosystem expansion.

- Contingency: A 5% reserve fund provides financial flexibility for unforeseen challenges.

- Deflationary Mechanisms: Transaction fee burns and token burns from premium services reduce circulating supply over time.

- Utility & Governance: Tokens offer discounts, staking opportunities, and voting rights, enhancing their value and empowering holders.

Conclusion

The tokenomics of Shell Token present a compelling framework for a decentralized ecosystem that seeks to redefine the relationship between consumers and the energy sector. By meticulously structuring its token supply, distribution, and utility, Shell Token aims to create a sustainable and valuable digital asset that rewards participation, promotes sustainability, and empowers its community. The fixed supply, coupled with strategic allocations and built-in deflationary mechanisms, positions Shell Token for long-term viability and growth in the dynamic world of digital currencies.

As the energy transition accelerates and blockchain technology continues to mature, projects like Shell Token offer a glimpse into a future where economic incentives and environmental responsibility are seamlessly aligned. Understanding these foundational aspects is key to appreciating the innovative potential of this initiative.

What are your thoughts on the detailed tokenomics of Shell Token? Do you believe this model effectively balances growth and sustainability? Share your insights with us in the comments below!

If you found this overview helpful, share this article with your friends and explore our related articles on the intersection of blockchain and sustainability to deepen your understanding.